Summer Economics: Money Lessons From An Allowance

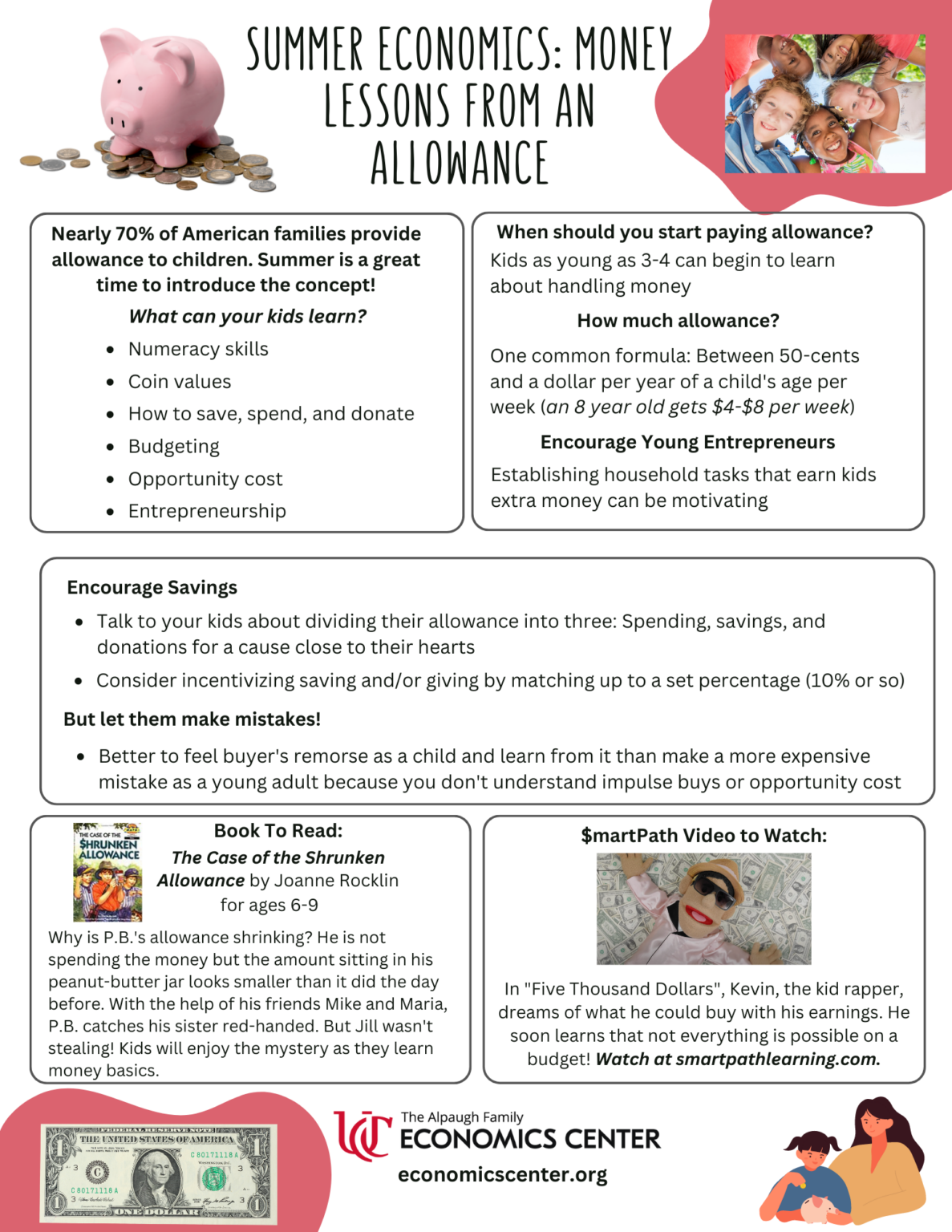

Summer is a great time to teach your kids the basics of money. And one of the best ways to do that is to incorporate those lessons into family fun! We’re here to help with easy, engaging activities that will build your kids’ financial literacy and math skills. This week, we’re talking about allowances, and the money and math skills that kids can learn from having one.

Many American families use an allowance system to try to help their children learn to manage money. The “how” of that looks different from family to family, and is not without controversy. Some parents feel strongly that allowance should be tied to kids’ completion of assigned household tasks, while others say that being a part of a household means pitching in without compensation. Those parents pay a standard allowance, but may set a list of premium tasks kids can do to earn extra money.

Those decisions are for parents to make, but once you’ve got the structure and expectations set for an allowance, it can be an excellent way for kids to get hands-on experience managing money. Younger kids will learn a lot counting coins and dollar bills. Older kids may benefit from managing a digital allowance, either through a first checking or savings program at a bank or credit union, or an allowance app. Below you’ll find suggestions for making sure your kids grasp key economic and personal finance concepts through an allowance.

Click the button below to download a PDF of this lesson!